A considerable indication for Canadian and united state flatbed truckers is arising from the decrease in lumber costs. This decline is resulting in significant production cuts by sawyers. Interfor, the third-largest lumber manufacturer in The United States and Canada, introduced on Thursday that it plans to minimize its output by 12 %. This reduction, totaling roughly 145 million board feet by year-end, or the matching of 12, 000 to 14, 000 flatbed truckloads. This will certainly include cuts across its sawmills in the U.S. South, Pacific Northwest, British Columbia, and eastern Canada. The business will attain this by minimizing hours, reconfiguring changes, and prolonging vacation breaks and upkeep shutdowns.

Obtain the clearest, most exact view of the truckload industry with data from DAT iQ.

https://www.youtube.com/watch?v=videoseries

Tune right into DAT intelligence Live, live on YouTube or LinkedIn , 10 am ET every Tuesday.

Domtar, a significant manufacturer, is carrying out significant operational adjustments, consisting of indefinite downtime at its Glenwood, Ark., sawmill, uncertain idling of an additional in Maniwaki, Quebec, and the removal of a shift at its Côte-Nord center in Quebec. Market analysts and investors anticipate more manufacturing cuts will be essential to attend to the present wood surplus. This may be a manageable problem, as boosted responsibilities have actually raised Canadian sawmills’ break-even costs each time of reducing need.

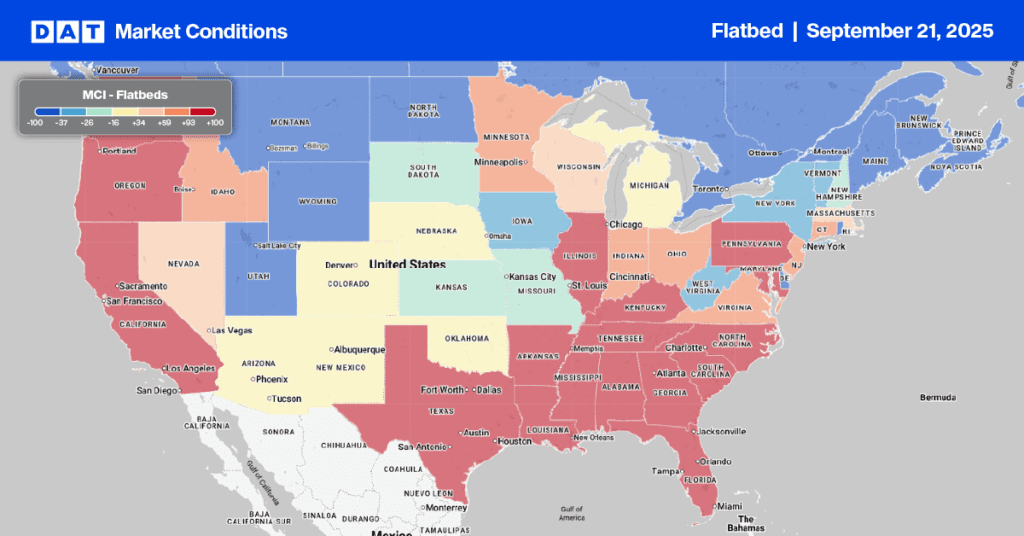

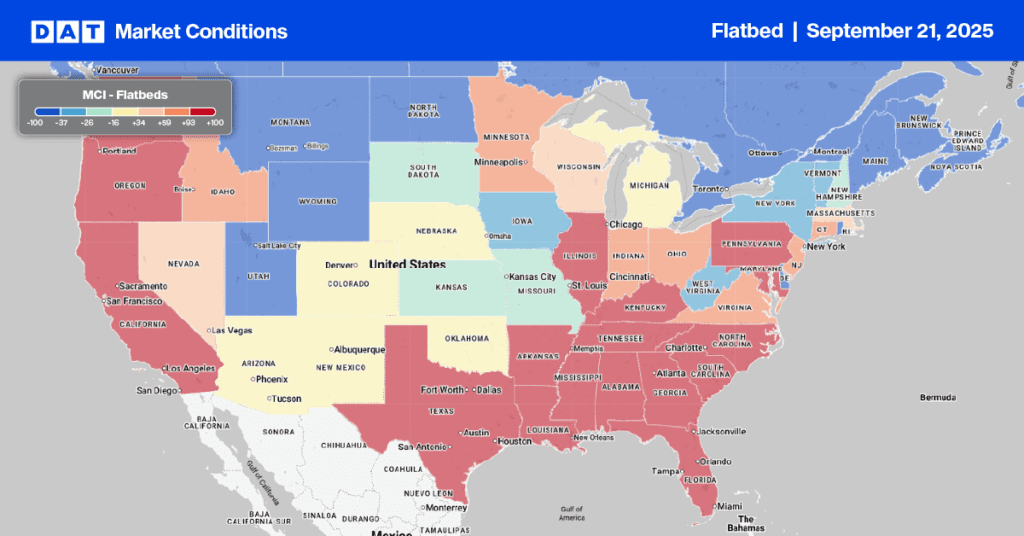

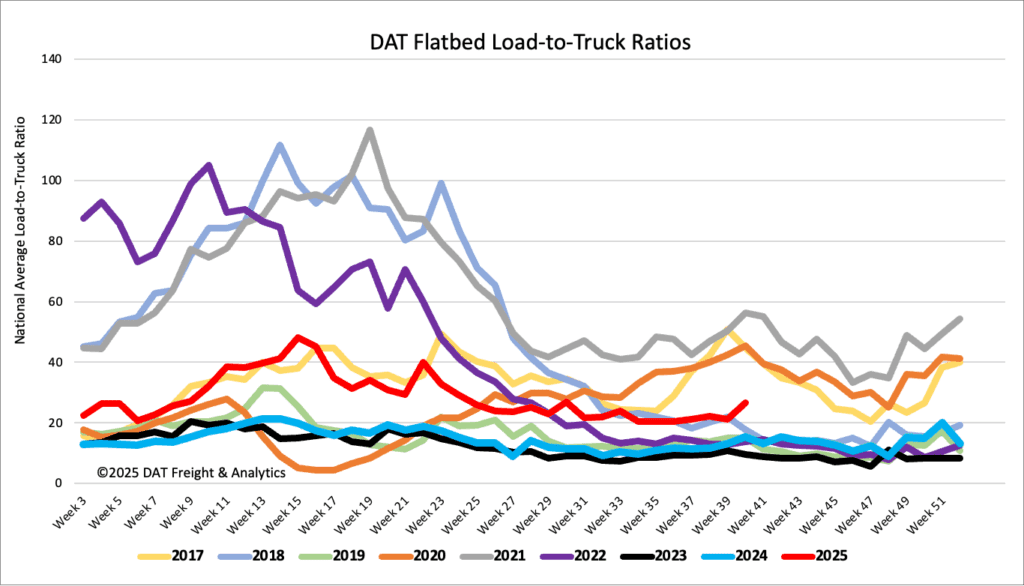

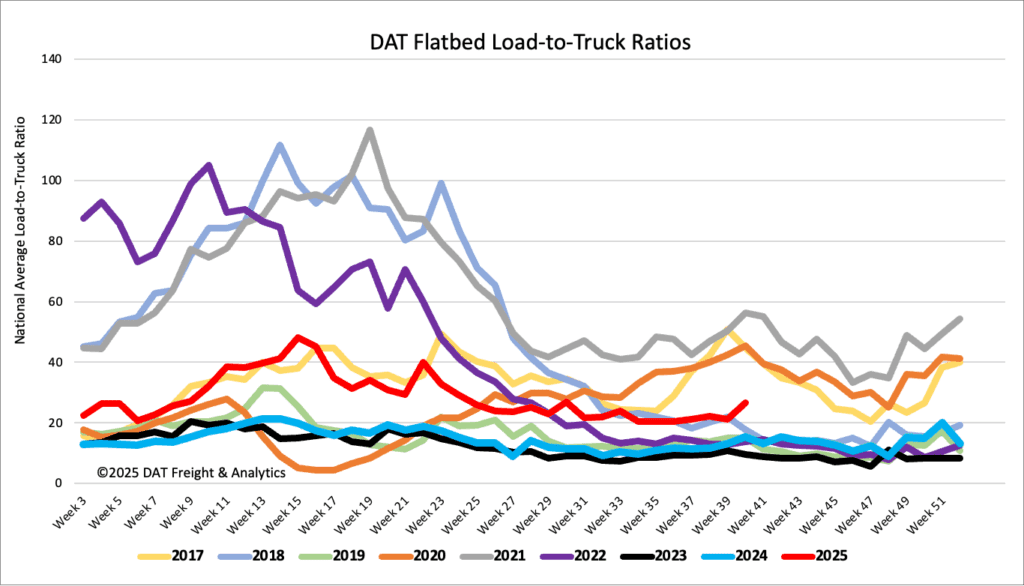

Load-to-Truck Proportion

Recently saw one more surge in flatbed load message volumes, up 25 % in the last month following last week’s 17 % increase. Carriers devices messages dropped 6 % leading to the flatbed load-to-truck ratio held consistent at 26 68

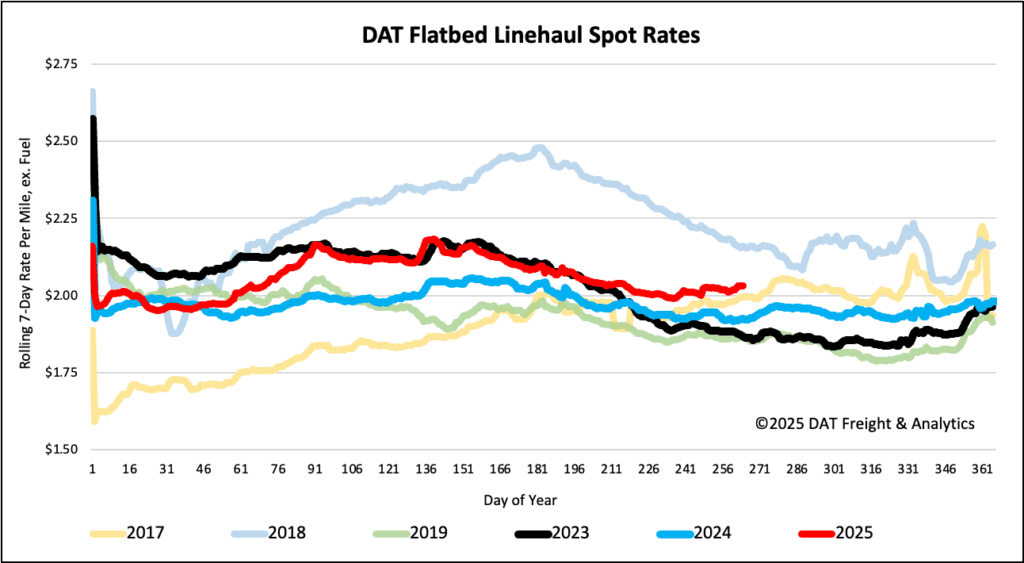

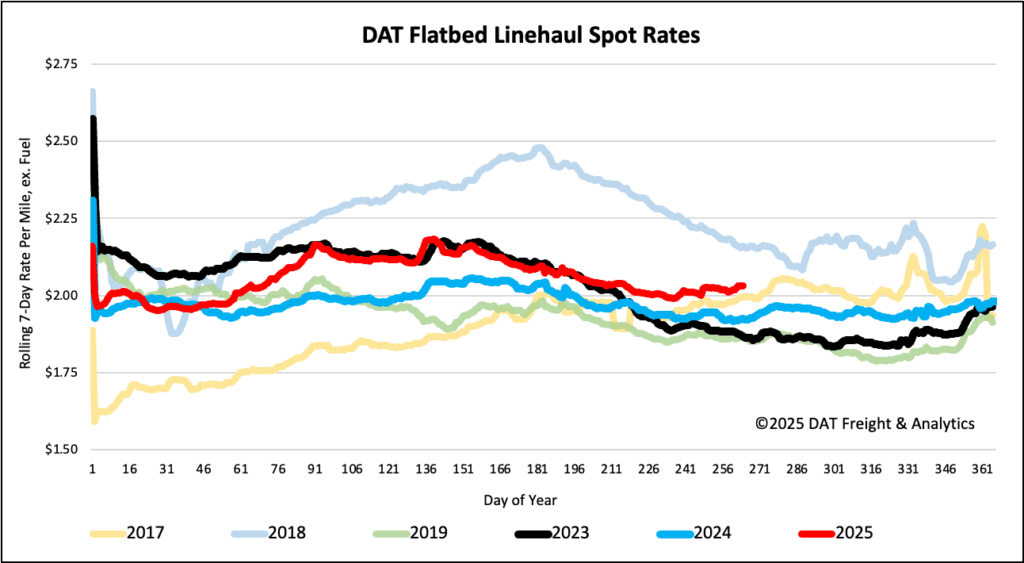

Spot prices

Last week, flatbed rates climbed to $ 2 05 per mile, an increase of simply over a cent. This rate is $0. 11 greater than last year, $0. 16 greater than in 2023, and keeps a $0. 04 per mile lead over 2017– a year that saw a really strong commercial economic situation for flatbed service providers. We are checking this pattern carefully, although it may merely be a coincidence.