In July 2025, the Logistics Supervisors’ Index ( LMI signed up a reading of 59 2, suggesting continued– however regulating– development in the logistics field. From a truckload carrier’s perspective, the standout trend is the expanding divide between tiny and big companies, with smaller sized logistics business driving a lot of the market’s energy (LMI: 62 1 vs. 56 2 for huge firms). These smaller gamers, lots of operating in the “middle-mile” sector, are holding elevated inventories imported ahead of brand-new tariffs, producing enhanced products quantities for upstream and local hauls. Transportation Usage increased greatly to 59 5, specifically amongst upstream companies, suggesting that demand for long-haul and regional products– specifically from ports and warehouse– is solid regardless of more comprehensive economic uncertainty.

https://www.youtube.com/watch?v=videoseries

Tune into DAT intelligence Live, survive on YouTube or LinkedIn , 10 am ET every Tuesday.

However, considerable price stress remain. Inventory and warehousing costs are still elevated, and diesel costs have reached $ 3 805 per gallon, squeezing margins for truckload service providers. At the same time, the complete influence of brand-new U.S. tariffs (currently balancing 18 3 %) has yet to play out throughout supply chains. Service providers should know changing need patterns, as downstream stores seem pulling back, developing potential soft spots in final-mile products. On balance, truckload service providers positioned in or near import-heavy hallways– or aligned with upstream representatives– stand to benefit from the present environment, but care is required as profession plan and gas prices continue to inject volatility right into the marketplace.

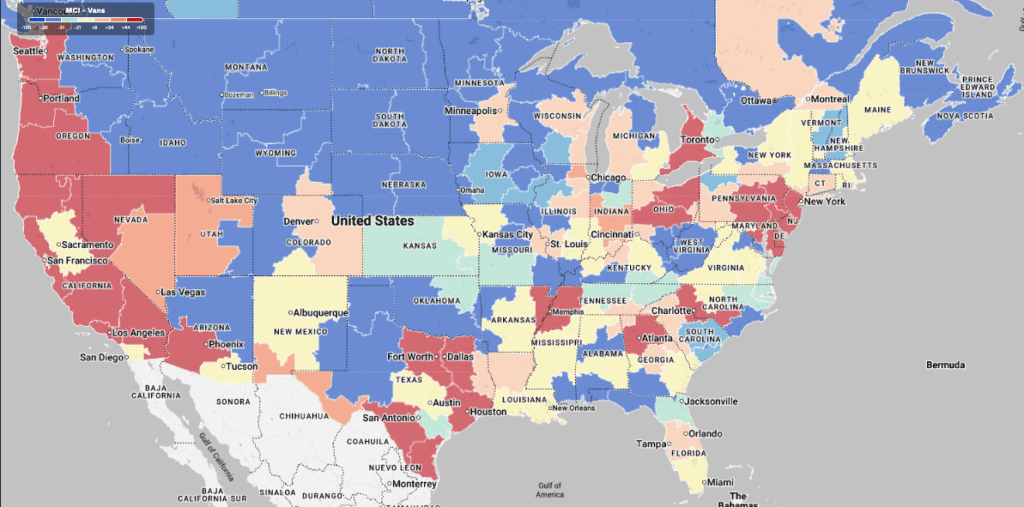

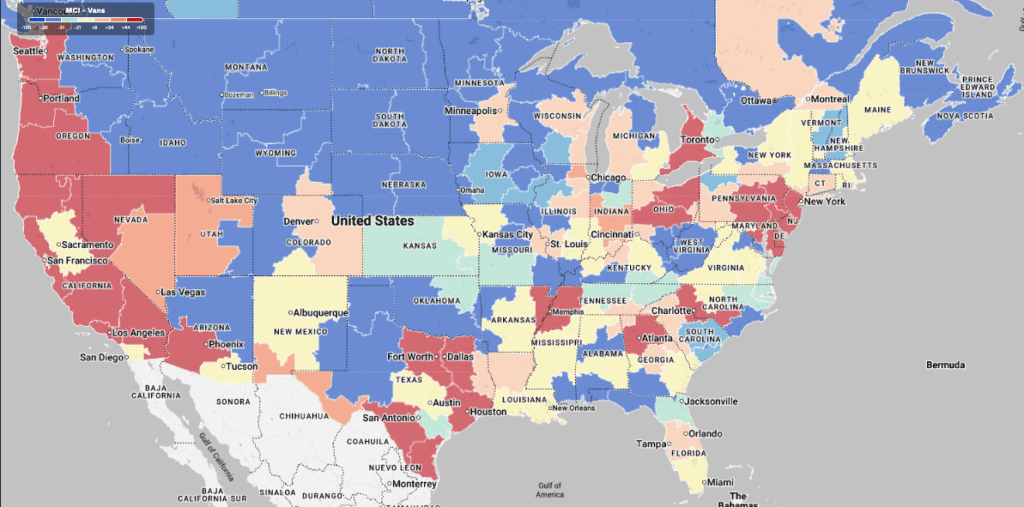

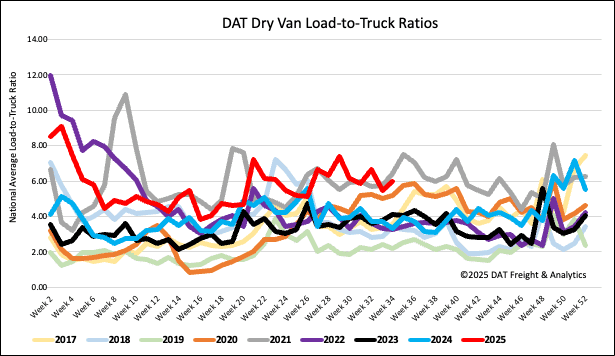

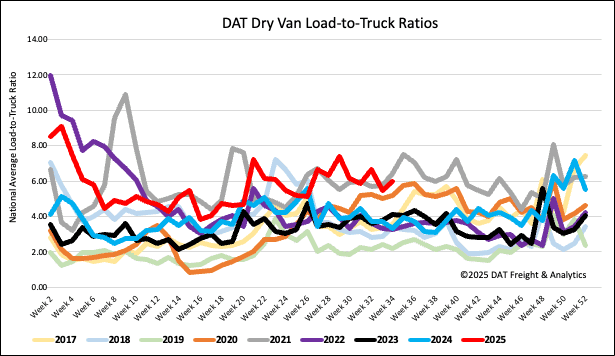

Load-to-Truck Ratio

Last week, dry van lots blog posts remained greatly unchanged, though ability saw a slight tightening as a result of an 8 % decrease in carrier equipment posts. Regardless of this, tons message quantities are still 11 % greater than last year and the long-term Week 33 standard (excluding the pandemic-influenced years of 2020, 2021, and2022 This resulted in the dry van load-to-truck proportion climbing 10 % to finish the week at 5 99

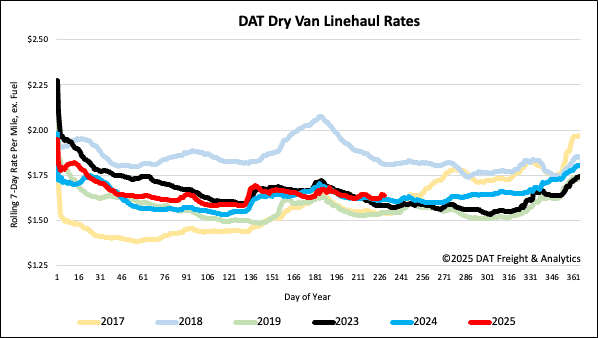

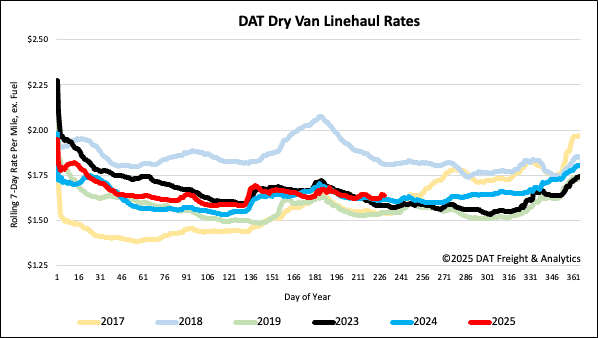

Linehaul area rates

Dry van linehaul area rates boosted by a penny last week, averaging just under $ 1 65 per mile, remaining $0. 02 higher than the exact same time last year and $0. 06 greater than in 2023

The typical rate for DAT’s leading 50 lanes by tons quantity stayed unmodified at $ 1 99 per mile for the 3rd week and $0. 34 more than the nationwide 7 -day moving average place price.

In the 13 vital Midwest states, which represent 46 % of national tons quantity and usually indicate future national fads, spot prices were down a penny on a 3 % greater volume of loads moved. Providers in these states made an average of $ 1 86 per mile for the second week, which is $0. 21 over the nationwide 7 -day rolling standard.