The products market runs in a continuous state of controlled turmoil. Market volatility swings hugely, capacity tightens up and loosens without warning, and pricing choices take place at lightning speed. Yet for all the electronic improvement occurring across logistics, one crucial piece of details has remained frustratingly nontransparent: What are shippers actually paying on the spot market?

This visibility space creates genuine troubles. Brokers discover themselves rating what shippers will certainly pay, typically leaving cash on the table or losing bargains to rivals. At the same time, carriers do not have the recognition tools they need to evaluate freight quotes, uncertain whether they’re obtaining fair market prices or being made use of throughout peak demand periods.

In the past, freight rates tools just showed half the tale. This incomplete photo pressures every person to choose with partial info– never ever optimal in a margin-sensitive industry where a few percentage factors can make or damage profitability.

Enter DAT’s new carrier area rate understandings: a game-changing criteria that lastly reveals shipper-paid place prices. This isn’t uncertainty or directional information– it’s real purchase details that gives both brokers and carriers the market knowledge they require for smarter, much more confident prices decisions.

What is the Shipper Area Rate?

The sector has never ever had something like Carrier Area Rate: a market-wide criteria of what shippers actually pay their carriers for place transport, not the final provider prices that consist of broker margin.

Developed from aggregated, anonymized purchase information across DAT’s ecosystem, this benchmark provides an independent sight right into real freight pricing. The information records actual payments from carrier to broker, offering customers unprecedented exposure right into market characteristics from the purchaser’s viewpoint. You’ll obtain:

- Independent standard: Unlike possibly biased or anecdotal resources, the Shipper Place Rate is stemmed from a detailed and unbiased collection of data, offering an honest market view.

- Margin openness: When combined with DAT’s existing broker place rates, customers can lastly recognize the complete picture– what providers receive, what shippers pay, and the spread in between them. It’s a 360 -level market sight with no voids.

- Contextual sights: The criteria consists of 13 -month historic lookbacks and peer comparisons, making it possible for users to find trends and verify present rates versus historical standards.

- Integrated experience: Readily available via DAT intelligence RateView, API combination, and Snow data sharing, making it available throughout various workflow choices.

Just how it compares to existing benchmarks

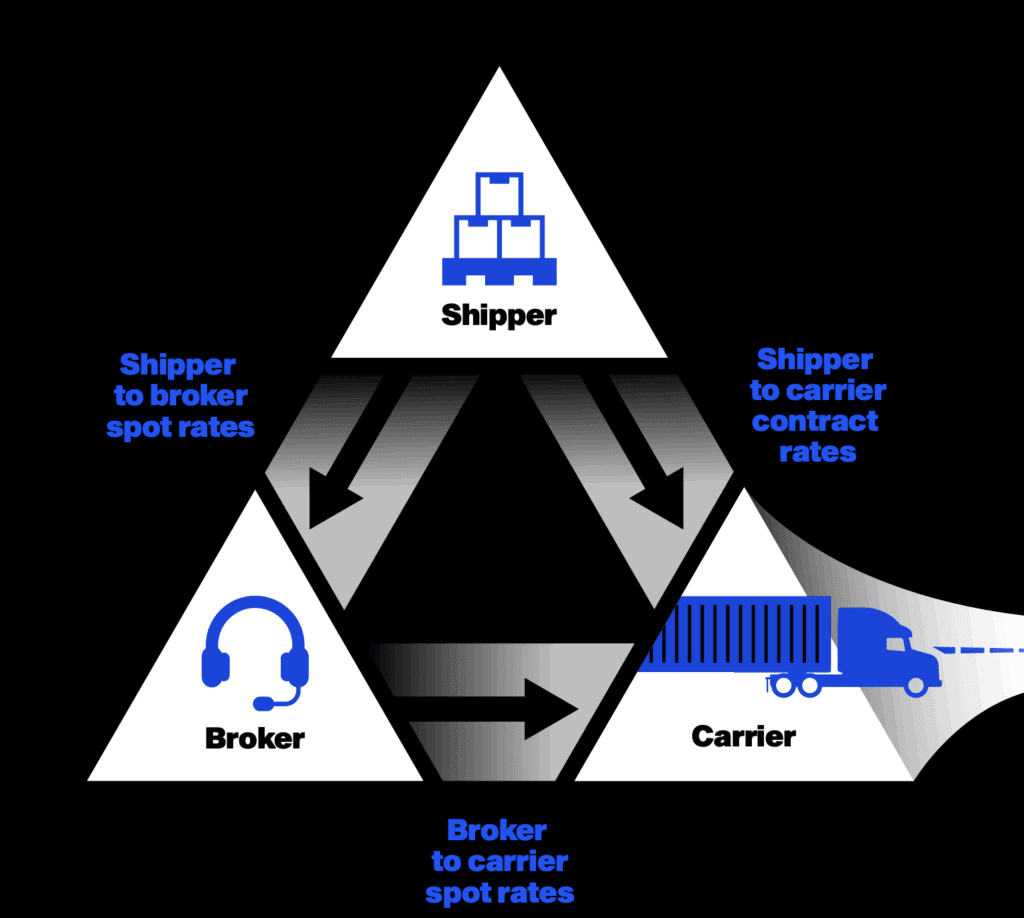

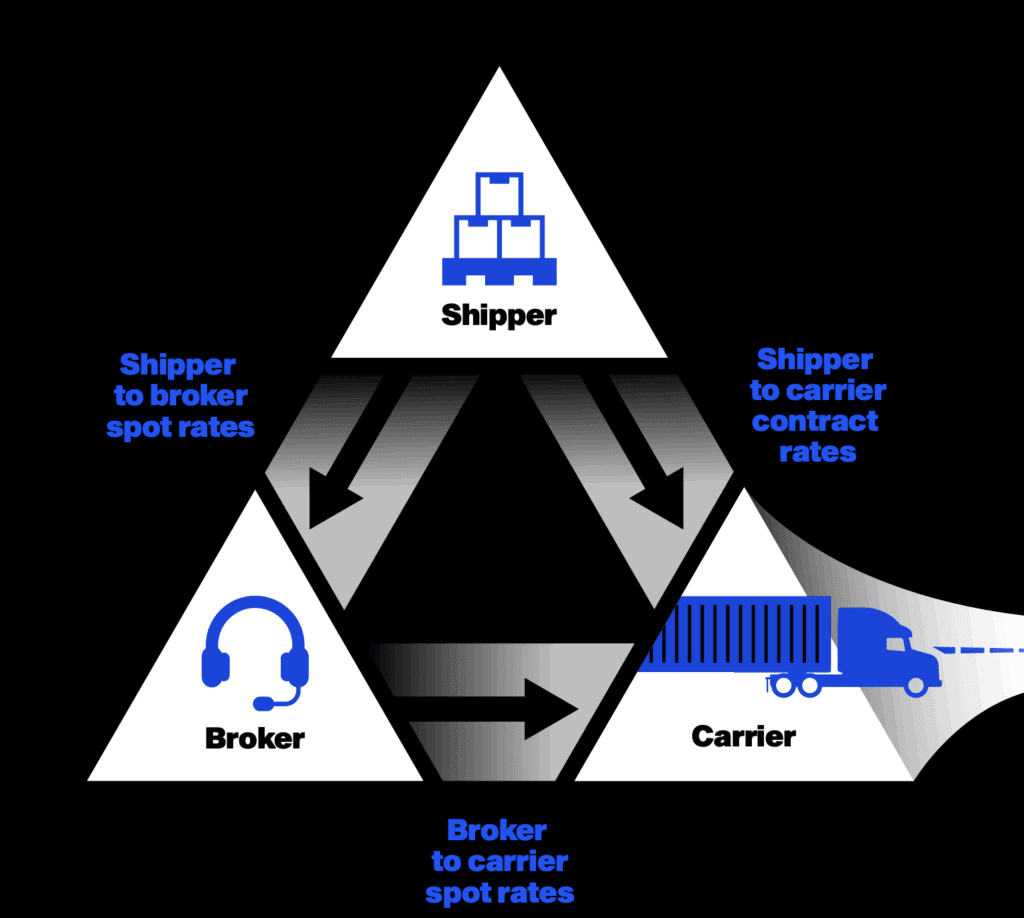

To understand the Carrier Place Price’s value, think about how it fits alongside other products rates benchmarks:

- Broker spot : Reveals ordinary rate paid to carriers– the buy side of broker deals

- Carrier contract : Shows longer-term contracts but does not record spot market volatility

- Carrier area: Typical rate shippers pay for place deliveries — the sell side for transportation suppliers

This three-dimensional view of products rates produces opportunities for products margin analysis and spot rate benchmarking that just weren’t feasible before.

Why brokers need a carrier area criteria– currently

For products brokers, the shipper spot price resolves a number of critical company difficulties that have continued for decades.

Margin visibility changes everything

Understanding what carriers really pay transforms how brokers come close to prices strategy. Rather than depending on intestine reaction or taking the rate paid to providers and simply including a percentage, brokers can currently see precisely where their prices stand relative to market reality.

This products margin analysis ability helps brokers identify possibilities to improve profitability without shedding competitive positioning. When you understand the marketplace is bearing higher prices than you’re billing, you can change as necessary. Alternatively, if your prices are over market, you can make tactical decisions regarding whether to preserve premium positioning or get used to improve win prices.

Smarter prices decreases uncertainty

Quote accuracy directly impacts broker success. Expensive, and you shed the business. Also low, and you win organization however shed earnings. The carrier area price removes much of this guesswork by offering genuine market information for prices decisions.

This data-driven method to freight quotes boosts win prices while shielding margins. Brokers can enter sales conversations with self-confidence, understanding their prices reflects real market problems as opposed to presumptions.

Competitive protection against electronic disruptors

Digital-first competitors commonly take advantage of innovation benefits to win service via remarkable market intelligence. Typical brokers counting on relationships and tribal knowledge discover themselves at a negative aspect when data-driven competitors can offer extra affordable, exact prices.

With this info, you level the having fun area. This products prices openness comes to be a competitive weapon instead of a vulnerability.

Move beyond tribal knowledge

Many brokerage firm operations still rely heavily on specific experience and partnerships for rates choices. While this expertise has worth, it comes to be an obligation when crucial employees leave or when entering brand-new lanes without historic context.

Carrier place rate information creates institutional understanding that goes beyond individual experience. Sales groups can reference unbiased market information in customer discussions, and leadership can make critical prices choices based upon detailed market knowledge instead of anecdotal proof.

Why the carrier area rate is essential for shippers

Transport supervisors and procurement professionals face their very own collection of challenges that carrier spot price insights straight attend to.

Quote recognition produces discussing power

When directing guides fall short or ability tightens, shippers usually find themselves facing broker quotes without strong criteria for evaluation. Being able to see the average carrier place price on any type of lane changes this dynamic by giving an independent reference point for what the market is in fact paying.

This recognition capability transforms arrangements. Rather than accepting quotes at face value, carriers can pressure-test pricing versus market truth. When brokers understand carriers have accessibility to market data, it motivates much more competitive first prices.

Budget plan accuracy improves monetary preparation

Many shippers have problem with area market spending plan difference due to the fact that they lack trusted criteria for just how much carriers pay for products in unstable conditions. Agreement rates offer security for core lanes, but spot exposure can create significant budget plan surprises.

Referencing shipper place prices enables even more accurate economic planning by providing practical cost benchmarks for place market exposure. Money teams can design scenarios and set proper backups based on real market data as opposed to inflated quotes.

Real-time market intelligence

Market problems alter swiftly in freight, and carriers need current info to make wise procurement choices. Historical agreement data becomes less relevant during volatile durations, while real-time place market knowledge assists shippers recognize present market characteristics.

This exposure helps shippers:

- React much faster when market problems change

- Stay clear of overpaying during urgent ability needs

- Construct internal self-confidence for area market purchase decisions

- Negotiate with data-backed sentence

Existing RateView consumers acquire full freight rate presence by including shipper-paid rates to their existing broker-paid rate data.

Target users across the company

Shipper spot rate insights serves advantage several roles within shipping companies:

- Transport supervisors use it for directing guide protection choices and place action evaluation.

- Procurement & & money leaders leverage it for authorizations, benchmarking, and critical invest preparation.

- Data experts and specialists incorporate it with various other DAT iQ tools for detailed products market analysis.

Usage cases

Comprehending the sensible applications of carrier area price analytics helps illustrate its value throughout different products management circumstances.

Broker process applications

Lane-level margin evaluation: Brokers can currently analyze productivity throughout certain lanes by contrasting buy prices (what they pay providers) versus sell rates (what the market pays carriers) and their very own rates.

Sales enablement: Sales teams enter client conversations equipped with present market information, improving reliability and pricing accuracy throughout settlements.

Management rates method: Executive teams can make informed decisions regarding prices approach, capability allotment, and market positioning based on detailed margin presence.

Carrier operations applications

Price quote validation during emergencies: When routing guides fall short and shippers need instant capability, they can verify broker quotes versus market standards in real-time.

Lane benchmarking: For lanes without agreement insurance coverage, shippers can make use of spot market data to recognize realistic prices expectations and examine broker propositions.

Procurement assistance: Throughout RFP processes or contract arrangements, purchase teams can reference actual market data to validate suggested prices and terms.

The workflow benefits expand beyond private purchases:

- Verify spot quotes in real-time throughout ability grinds

- Act quickly when directing guides stop working with confidence in pricing decisions

- Justify decisions with tidy, third-party information to inner stakeholders

- Compare broker rates without margin uncertainty during supplier evaluations

How to access the Shipper Area Price understandings

Getting started with the Carrier Spot Price is uncomplicated for existing DAT customers and brand-new individuals alike.

Gain access to options

The criteria is readily available as a RateView add-on for both broker and shipper individuals with several channels:

- Rate lookup API: Incorporate carrier place rate information straight into existing TMS, purchase, or pricing systems for automated decision-making.

- DAT intelligence RateView: Gain access to single-lane lookups via the acquainted RateView interface, with multi-lane performance coming soon.

Application assistance

DAT offers extensive support for applying the Carrier Place Rate statistics right into existing operations. Whether you’re looking for easy UI access or complex API integration, the DAT group can assist maximize the execution for your certain usage instance.

Real market truth for smart decisions

The freight market has operated with incomplete prices details for also lengthy. Brokers have guessed at what shippers would certainly pay, carriers have approved quotes without solid standards, and every person has made decisions with partial market exposure.

Carrier place price data from DAT iQ changes this vibrant fundamentally. For the very first time, both sides of products deals have access to the same market fact. This products rates openness creates opportunities for far better decision-making, improved margins, and a lot more effective market working. Prepared to see it in action? Connect to your account manager to get started.