Home Ways and Ways Chairman Jason Smith lately highlighted the potential benefits of President Trump’s profession program in an op-ed for the Washington Supervisor. However, the realities dealt with by companies like Deere & & Co. recommend a different story. The ranch devices maker is readied to lay off 238 workers due to a considerable drop in net income and sales, attributed to reduced asset prices and the economic problem of tariffs, which have actually set you back the company around $ 300 million year-to-date. Deere’s pretax tariff-related damages are forecasted to reach $ 600 million for the current , raising issues regarding the effect of such plans on work within the functioning course.

Obtain the clearest, most precise view of the truckload marketplace with information from DAT iQ.

https://www.youtube.com/watch?v=videoseries

Tune into DAT iQ Live, reside on YouTube or LinkedIn , 10 am ET every Tuesday.

Despite cases that tolls can lead to increased investment and financial growth, proof recommends the opposite. Lots of united state producers, consisting of Caterpillar Inc., expect substantial tariff-related expenses that might hinder their operations and discourage consumer financial investments. Additionally, the U.S. farming industry is dealing with difficulties, particularly with reduced exports to China, which fell substantially this year. Generally, profession policies appear to be bring upon financial pain, contradicting the story of a booming economic situation benefitting American workers, truckers and farmers.

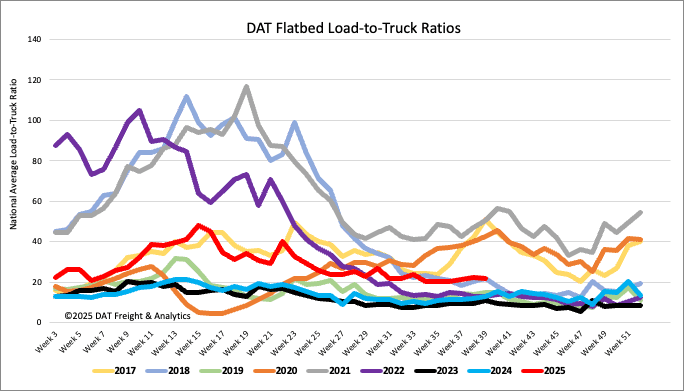

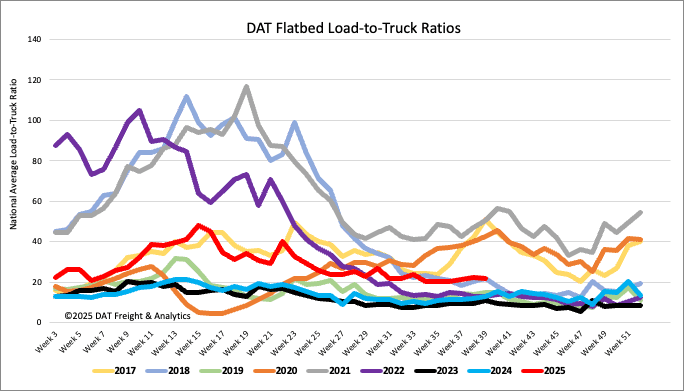

Load-to-Truck Proportion

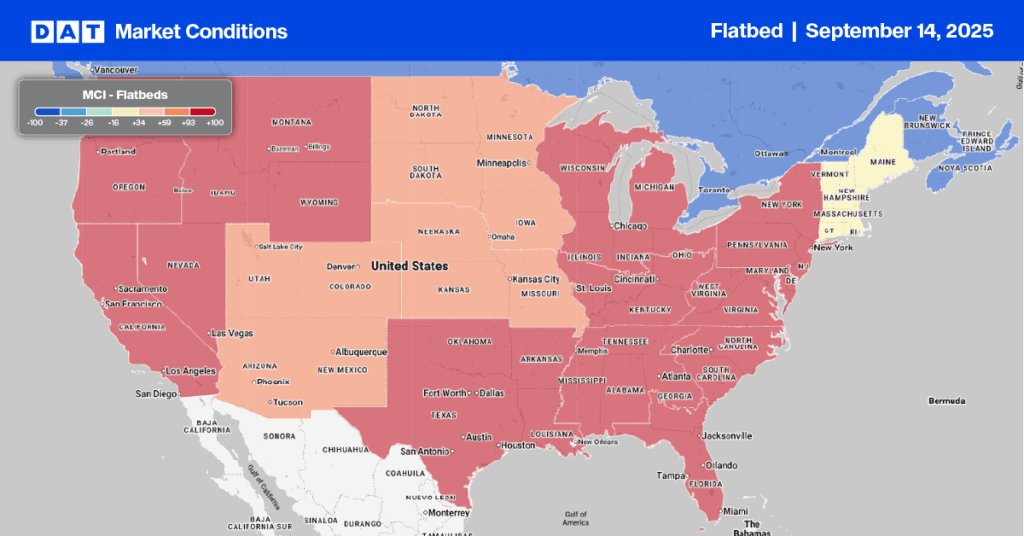

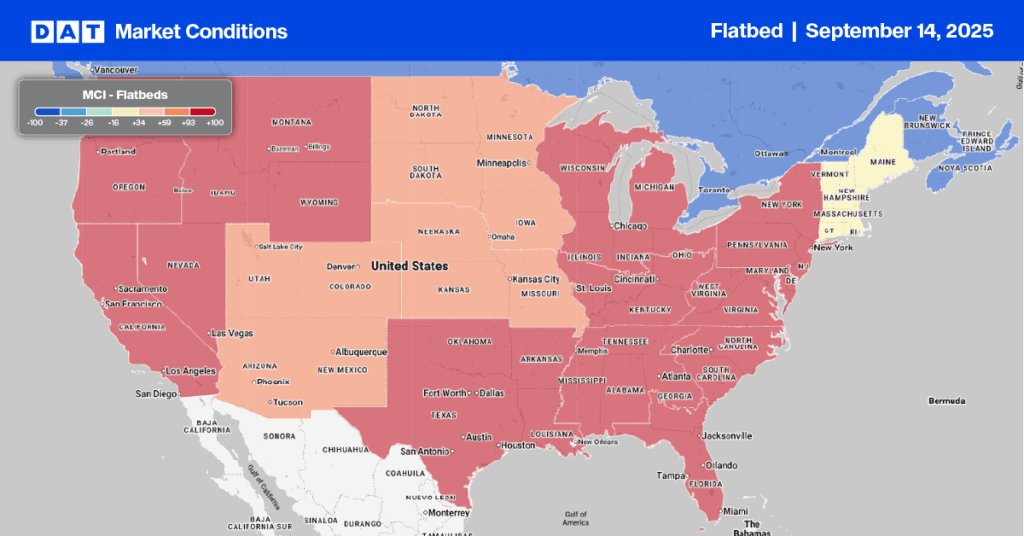

Recently saw a significant rise in flatbed load post volumes, reaching their acme in nearly 2 months. This surge pushed quantities 22 % greater contrasted to the very same period last year. Regardless of service providers coming back the marketplace after the Labor Day holiday and numerous truck reveals across the country, the flatbed load-to-truck ratio held steady at 22 02

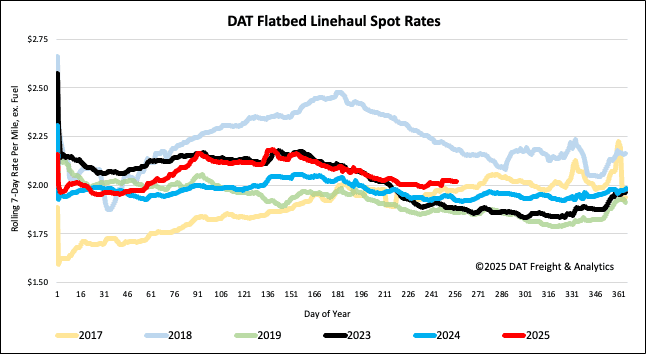

Spot prices

Recently, flatbed prices stopped by $0. 03 per mile, balancing $ 2 03 per mile, erasing fifty percent of the gains from the previous 2 weeks. Regardless of this dip, prices continue to be solid for spot market flatbed carriers, standing $0. 10 per mile greater than last year and $0. 14 more than in 2023, indicating a very positive year for them.