On the cost side, staples like beef, coffee, eggs, and chocolate have climbed greatly, with food costs up 21 % over four years– outpacing broader wholesale rising cost of living. Slim margins (3– 5 %) leave little space for error, and tariffs from Head of state Trump’s trade war danger pushing costs higher still. Labor costs and shortages intensify the strain, as many restaurants battle to locate competent candidates and must consider elevating earnings to complete. Immigration suppressions have actually likewise tightened the workforce.

Obtain the clearest, most accurate view of the truckload industry with information from DAT iQ.

https://www.youtube.com/watch?v=videoseries

Tune into DAT intelligence Live, live on YouTube or LinkedIn , 10 am ET every Tuesday.

On the demand side, diners are dining in restaurants much less, resulting in one of the weakest six-month growth durations for restaurant and bar sales in a decade. Low-income households– currently stressed by years of high rising cost of living– are trading to cheaper menu products or food preparation in your home, and now middle-income houses are really feeling the pinch too. Customers are being extra value-conscious, reluctant to accept higher costs unless they match regarded top quality. Grocery shopping patterns echo this caution, with individuals buying smaller amounts, changing to save brand names, and avoiding non-essentials. While some markets fresh York City see durable restaurant website traffic, much of the country faces depressed volumes and an increasingly mindful customer base.

The National Restaurant Organization’s Dining establishment Efficiency Index ( RPI , which is a monthly composite index that tracks the health and wellness of the U.S. dining establishment sector, held fairly stable in June, as restaurant drivers remained to report combined sales and traffic results. Restaurant operators reported rather softer same-store sales in June, after a bulk registered higher sales in May. Looking in advance, dining establishment drivers are cautiously optimistic regarding sales gains in the coming months. Nevertheless, their overview for the overall economic climate remains to lean negative.

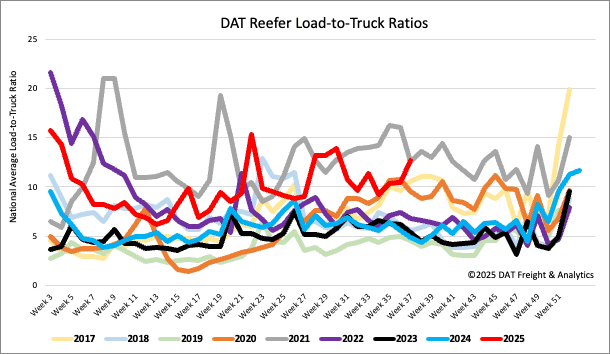

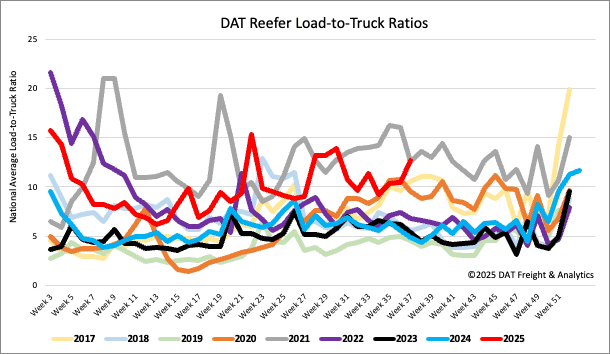

Load-to-Truck Proportion

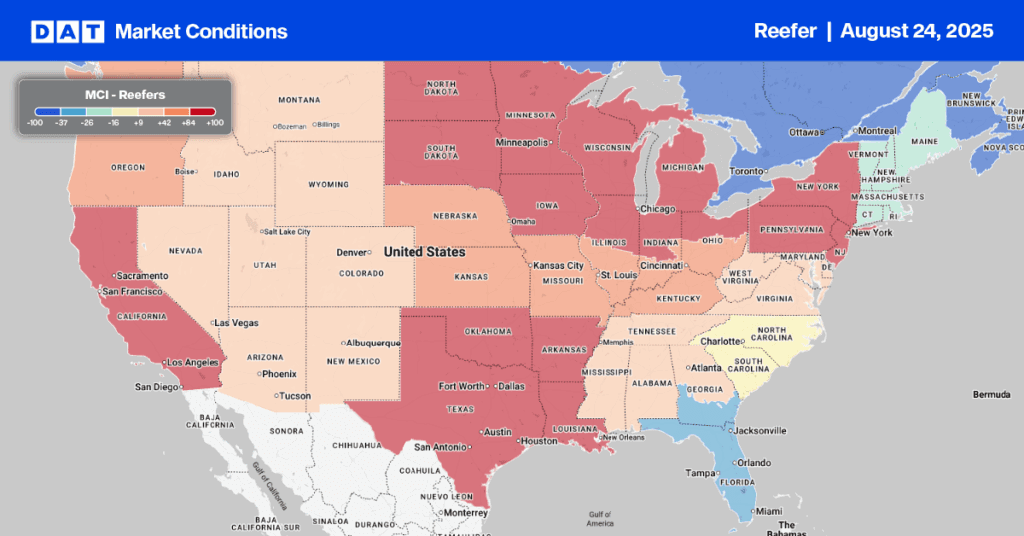

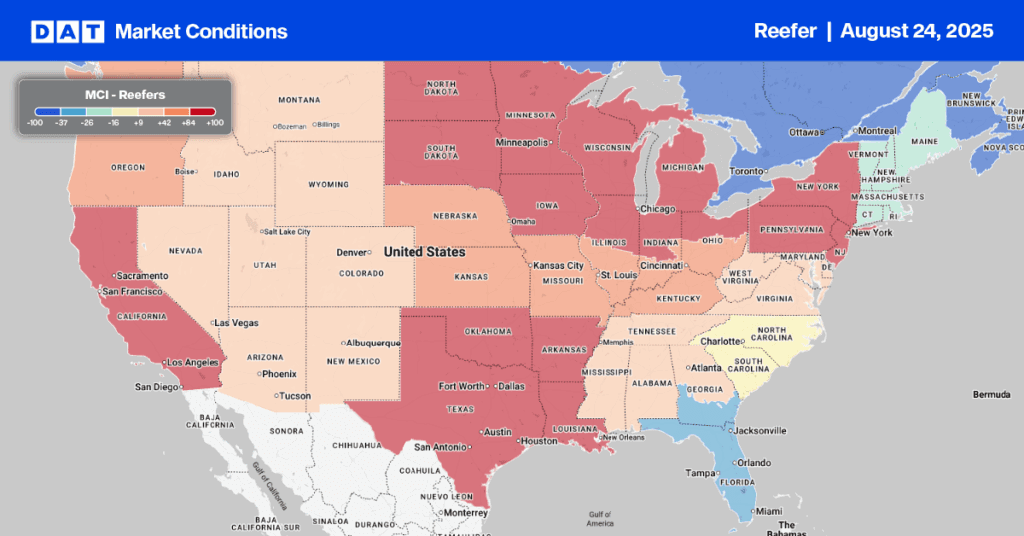

Recently, reefer spot market volumes saw a significant boost, increasing 19 % week over week and an impressive 44 % year over year. This surge popular, combined with a 2 % decline in carrier devices articles, brought about a 22 % boost in the reefer load-to-truck ratio, which currently stands at 12 71

Spot rates

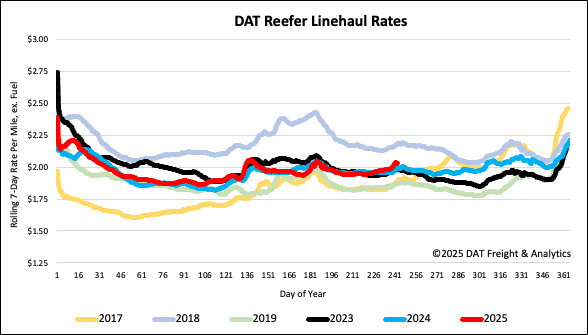

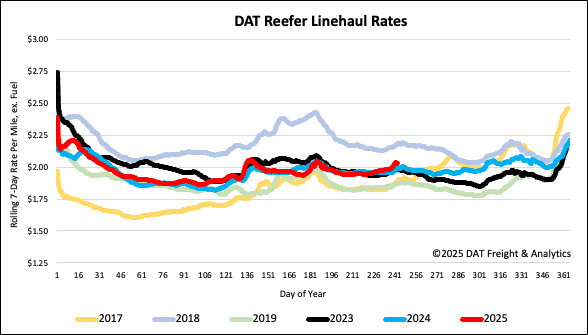

Labor Day weekend break brought a remarkable tightening up in reefer place capacity, building on the previous week’s 3 % rise in nationwide lots motions. This caused a $0. 07 per mile increase in reefer rates, reaching just over $ 2 04 per mile– a figure $0. 04 greater than both in 2015 and 2023